DY6 Metals Ltd ($DY6.AX)

an early-stage rare earth elements and critical metals exploration company

Executive Summary

DY6 Metals Ltd is an early-stage rare earth elements and critical metals exploration company listed on the Australian Securities Exchange since June 29, 20231. The company owns a portfolio of highly prospective heavy rare earth and critical metal projects in Southern Malawi, a proven region for hosting economic REE deposits2. With a current market capitalization of approximately A$9.36 million3, DY6 represents a micro-cap investment opportunity in the critical minerals sector, though it carries significant exploration-stage risks.

I. Historical Background

Company Formation and Milestones

DY6 Metals Ltd was incorporated in November 20224 and was founded with a specific focus on heavy rare earth elements, particularly dysprosium (Dy) and terbium (Tb)5. The company name "DY6" derives from dysprosium's chemical symbol "Dy" and atomic number "66"5.

Key Historical Milestones:

November 2022: Company incorporation4

June 29, 2023: Successful ASX listing following a $7 million IPO1

2023: Acquisition of three highly prospective projects in Southern Malawi4

2024: Completion of maiden drilling campaigns and expansion of project portfolio6

2025: Expansion into Cameroon with rutile and heavy mineral sands projects7

The company secured $2.5 million in IPO commitments from two strategic cornerstone investors: Zhenshi Group (HK) Heshi Composite Materials Co., Limited and other strategic investors4.

II. Business Model Overview

Core Business Strategy

DY6 Metals operates as a mineral exploration and development company with a focused strategy on achieving exploration success and discovering potentially economic mineral deposits capable of being developed in Malawi8. The company's business model centers on:

Exploration and Resource Definition: Systematic exploration of heavy rare earth and critical metal projects

Strategic Acquisitions: Acquiring prospective tenements in proven geological provinces

Value Creation Through Discovery: Building shareholder value through exploration success and resource discoveries

Future Development: Progression towards feasibility studies and eventual mining operations

Revenue Generation Mechanisms

Currently, DY6 generates minimal revenue, with only A$99,058 recorded in 2024 from interest income6. As an exploration-stage company, future revenue will depend on:

Successful exploration leading to resource definitions

Development of mining operations

Sale of rare earth concentrates and critical minerals

Potential joint ventures or asset sales

Unique Value Propositions

Heavy Rare Earth Focus: Specialization in high-value heavy rare earths (dysprosium, terbium)5

Strategic Location: Projects located in Southern Malawi, a proven REE province2

Diversified Portfolio: Multiple projects across different commodity types2

Clean Balance Sheet: Minimal debt and strong liquidity position3

III. Revenue Segments Analysis

Current Revenue Breakdown (2024)

Revenue SourceAmount (A$)PercentageInterest Income99,058100%Total Revenue99,058100%

Project Portfolio by Commodity Type

DY6's projects span multiple critical minerals2:

ProjectPrimary CommoditiesArea (km²)StatusMachingaHeavy REE, Niobium197GrantedTunduluREE, Phosphate, Gallium91.5GrantedSalambidweREE, Niobium24.9GrantedNgala HillPGE, Copper, Nickel16.4GrantedMzimbaLithium710.5PendingKarongaCopper, Lithium36.2Granted

Geographic Distribution

IV. Financial Performance Review

A. 5-Year Financial Analysis

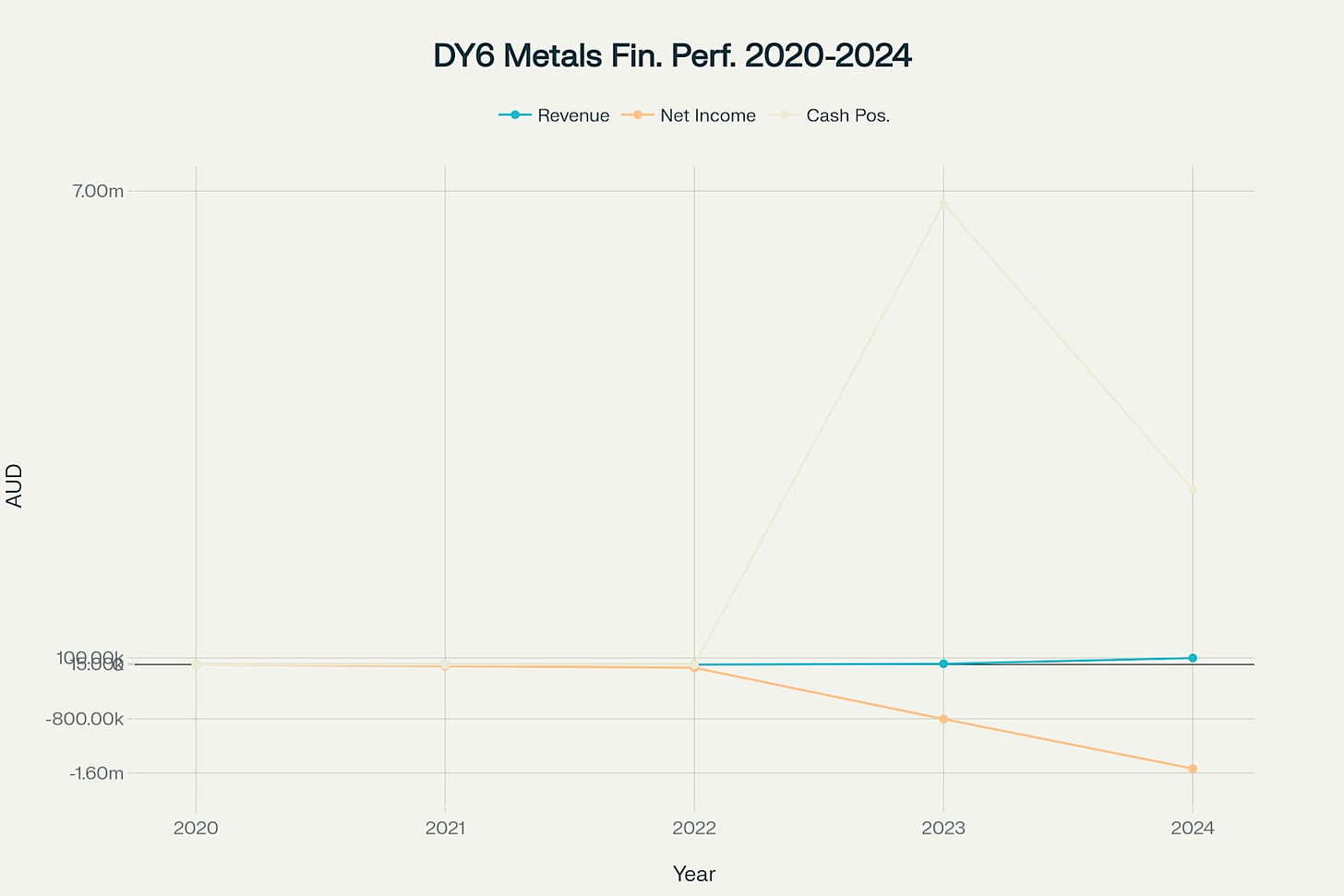

YearRevenue (A$)Net Income (A$)Total Assets (A$)Cash (A$)Market Cap (A$)202499,058(1,536,145)7,506,9242,586,8139,360,000202314,460(803,315)8,611,9486,816,291N/A (pre-listing)20220(44,980)N/AN/AN/A20210(20,080)N/AN/AN/A202000N/AN/AN/A

DY6 Metals Financial Performance Timeline (2020-2024)

B. Financial Ratios Calculation and Interpretation

1. Price-to-Earnings (P/E) Ratio

Current Status: Not applicable - company is loss-making

Earnings per Share (2024): -A$0.0263 (loss per share)

Industry Comparison: N/A due to pre-revenue status

Investor Significance: P/E ratio will only become relevant once the company achieves profitability

2. Return on Equity (ROE)

2024 Calculation: -21.20%

Method: Net Loss (A$1,536,145) ÷ Shareholders' Equity (A$7,247,265)

5-Year Trend: Consistently negative due to exploration-stage losses

Industry Benchmark: Not comparable - typical for exploration companies

3. Return on Assets (ROA)

2024 Calculation: -20.46%

Method: Net Loss (A$1,536,145) ÷ Total Assets (A$7,506,924)

Performance Interpretation: Reflects exploration-stage company status

Efficiency Assessment: Assets primarily consist of exploration expenditure and cash

4. Debt-to-Equity Ratio

Current Position: 0.036 (very low leverage)

Calculation: Total Liabilities (A$259,659) ÷ Total Equity (A$7,247,265)

Financial Risk Assessment: Minimal financial leverage risk

Strategic Implications: Conservative financial structure provides operational flexibility

V. Quarterly Earnings Report Analysis

Latest Half-Year Results (31 December 2024)

Key Financial Metrics:

Net Loss: A$615,971 (vs A$756,921 in H1 2023)10

Cash Position: A$1,705,410 (decreased from A$2,586,813 at June 2024)10

Operating Cash Flow: -A$718,455 (cash used in operations)10

Current Ratio: 31.41 (excellent liquidity position)

Operational Highlights:

Completion of metallurgical sampling at Tundulu Project10

Reconnaissance sampling at Ngala Hill PGE Project10

Cost reduction measures implemented (director fees reduced 17-26%)10

Loyalty options offering raised A$204,75010

Management Guidance:

Focus on maximizing funding for exploration activities10

Continued exploration across existing project portfolio

Assessment of Cameroon opportunities7

VI. Growth Prospects Assessment

Potential Growth Drivers:

Exploration Success: Discovery of economic mineral deposits across project portfolio

Resource Definition: Advancement to JORC-compliant resource estimates

Gallium Discovery: High-grade gallium mineralisation identified at Tundulu11

Geographic Expansion: Entry into Cameroon rutile market7

Critical Minerals Demand: Growing global demand for REE and critical minerals

5-Year Forecast Considerations:

Due to DY6's early exploration stage, traditional revenue forecasting is not applicable12. However, key milestones over the next 5 years may include:

Years 1-2: Resource definition and metallurgical studies

Years 3-4: Feasibility studies and permitting

Years 5+: Potential development decisions and production

Market Expansion Strategies:

Malawi Focus: Continued exploration and development of existing projects

Cameroon Entry: Development of rutile and heavy mineral sands projects13

Strategic Partnerships: Potential joint ventures for project development

VII. SWOT Analysis

A. Strengths

Multiple High-Quality Projects: Diversified portfolio across proven geological province2

Strategic Location: Projects in Southern Malawi, a recognized REE hub14

Clean Balance Sheet: Minimal debt (0.036 debt-to-equity ratio)

Experienced Management: Team with proven exploration and development expertise15

Strong Liquidity: 14.2 months cash runway at current burn rate

B. Weaknesses

Pre-Revenue Stage: No operational income, dependent on exploration success

High Cash Burn: Monthly burn rate of A$119,742

Small Market Cap: Limited financial resources compared to peers

Geographic Concentration: Heavy dependence on Malawi jurisdiction

No Proven Reserves: All projects at early exploration stage

C. Opportunities

Critical Minerals Boom: Growing global demand for REE and critical minerals16

Supply Chain Diversification: Global push to reduce Chinese REE dependence14

Technology Sector Growth: Increasing demand for permanent magnets in EVs and renewables17

Government Support: Australian government focus on critical minerals development

African Mining Development: Increasing investment in African mineral projects14

D. Threats

Commodity Price Volatility: REE prices subject to significant fluctuations

Regulatory Risks: Operating in developing country with potential policy changes

Competition: Larger, better-funded competitors in the same region

Technical Risks: Exploration may not result in economic discoveries

Funding Challenges: May require additional capital raising diluting existing shareholders

VIII. Competitive Landscape

Market Position Analysis

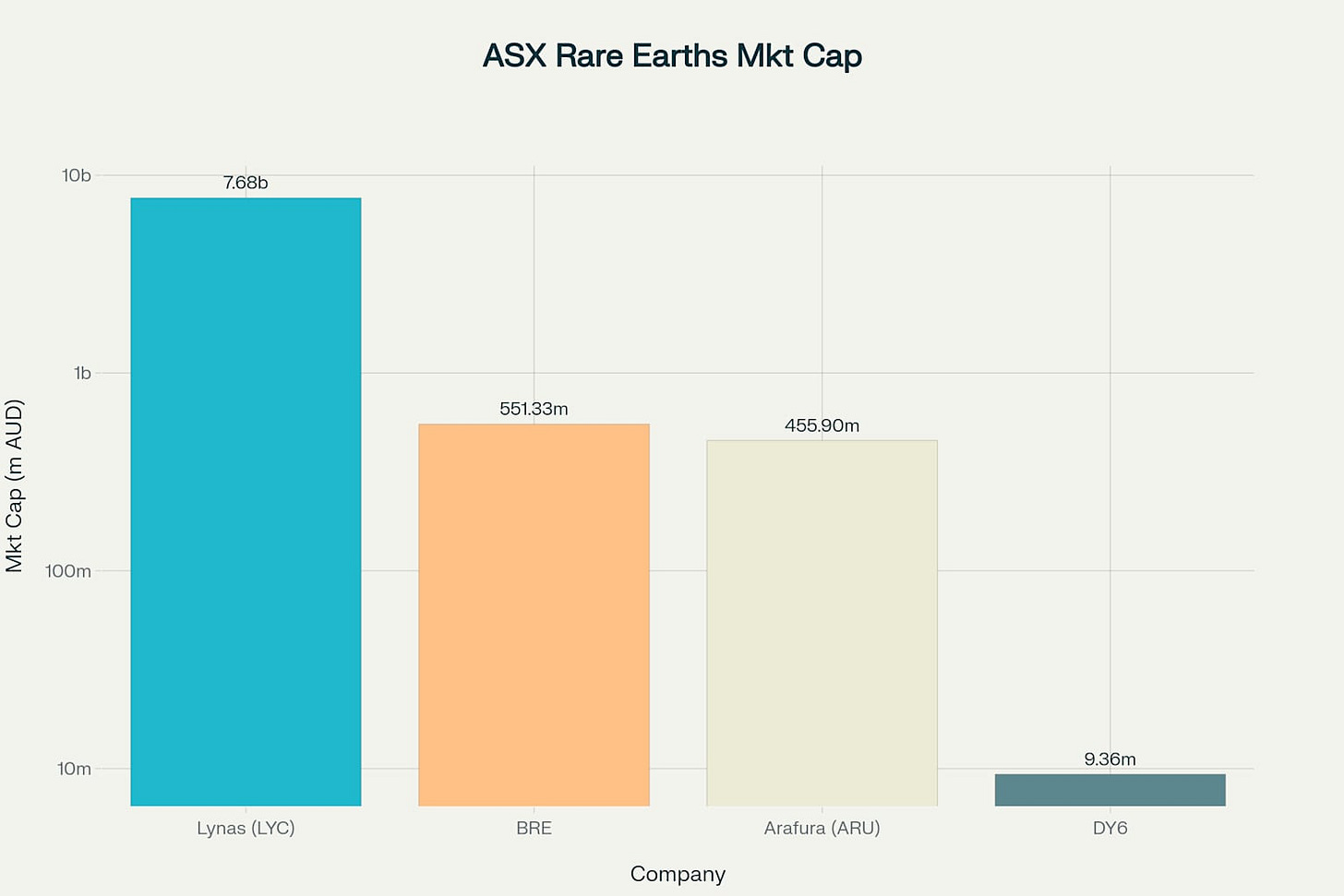

Market Capitalization Comparison: DY6 Metals vs ASX Rare Earth Competitors

Top ASX Rare Earth Competitors:

CompanyMarket Cap (A$M)StatusKey AssetsLynas Rare Earths (LYC)7,680ProducerMt Weld (WA), Malaysia processingBrazilian Rare Earths (BRE)551DeveloperMonte Alto, BrazilArafura Rare Earths (ARU)456DeveloperNolans Project, NTDY6 Metals (DY6)9.4ExplorerMalawi projects

Competitive Analysis:

Versus Lynas Rare Earths (LYC)18:

Size Differential: Lynas is 820x larger by market cap

Operational Status: Lynas is the only major REE producer outside China

Advantages: Proven production capability, established supply chains

DY6 Opportunity: Focus on heavy REE vs Lynas' light REE emphasis

Versus Arafura Rare Earths (ARU)19:

Development Stage: ARU more advanced with Nolans Project

Size Differential: ARU is 49x larger by market cap

Geographic Focus: Both target similar commodity mix

DY6 Advantage: Multiple projects vs single asset concentration

Versus Brazilian Rare Earths (BRE)20:

Size Differential: BRE is 59x larger by market cap

Geographic Focus: Both operate in developing countries

Commodity Mix: Similar rare earth focus

DY6 Advantage: More advanced exploration stage in some projects

Competitive Advantages/Disadvantages:

DY6 Advantages:

Multiple project diversification reduces single-asset risk

Focus on high-value heavy rare earths

Clean balance sheet provides financial flexibility

Early entry into proven REE province

DY6 Disadvantages:

Significantly smaller scale limits development capacity

Limited financial resources for large-scale development

Early exploration stage versus more advanced competitors

Dependence on external funding for growth

Final Recommendation

Investment Assessment

Financial Health: Moderate Risk

Strong liquidity position with 14.2 months cash runway

Clean balance sheet with minimal debt

Consistent exploration expenditure supporting asset development

Cost management measures demonstrate prudent financial stewardship

Growth Potential: High Risk/High Reward

Significant upside potential if exploration successful

Multiple commodities and projects provide diversification

Exposure to critical minerals sector growth trends

Early-stage nature means substantial execution risk

Investment Attractiveness: Speculative Buy for Risk-Tolerant Investors

DY6 Metals represents a speculative investment opportunity in the critical minerals sector. The company's portfolio of rare earth and critical metal projects in proven geological provinces offers significant upside potential, but carries substantial exploration-stage risks.

Suitable for investors who:

Seek exposure to critical minerals sector growth

Can tolerate high volatility and potential total loss

Understand exploration-stage investment risks

Have a long-term investment horizon (3-5+ years)

Not suitable for investors seeking:

Current income or dividends

Low-risk, stable returns

Short-term trading opportunities

Conservative portfolio allocations

Key Catalysts to Monitor

Drill results and resource estimates from current programs

Metallurgical test work results

Progress toward JORC resource compliance

Partnership or joint venture announcements

Expansion of Cameroon operations

Critical minerals market developments

Disclaimer: This analysis is based on available public information as of July 2025 and should not be considered financial advice. All investments in exploration-stage mining companies carry substantial risks including potential total loss of capital. Investors should conduct their own due diligence and consult with qualified financial advisors before making investment decisions. Past performance does not guarantee future results, and the volatile nature of commodity markets and early-stage mining companies can result in significant price fluctuations.

https://www.morningstar.com.au/investments/security/asx/dy6/summary

https://smallcaps.com.au/dy6-metals-cameroon-acquisition-high-potential-rutile-hms-assets/

https://dy6metals.com

https://www.moore-australia.com.au/news-and-views/june-2023/dy6-metals-ltd-debuts-on-asx

https://discoveryalert.com.au/news/dy6-metals-heavy-mineral-deposits-cameroon/

https://www.reuters.com/markets/companies/DY6.AX/financials/income-annual

https://discoveryalert.com.au/news/rare-earth-element-company-high-grade-gallium-malawi/

https://dy6metals.com/wp-content/uploads/2023/09/DY6-2023-Annual-Report.pdf

https://www.listcorp.com/asx/dy6/dy6-metals-ltd/news/half-year-report-3165298.html

https://investingnews.com/dy6-quarterly-activities-report-for-the-period-ended-30-june-2024/

https://www.morningstar.com.au/investments/security/ASX/DY6/financials

https://hotcopper.com.au/data/announcements/ASX/6A1171507_DY6.pdf

https://announcements.asx.com.au/asxpdf/20250314/pdf/06gnbxr7fqszcp.pdf

https://www.marketscreener.com/quote/stock/DY6-METALS-LTD-153435041/finances-income-statement/

https://www.marketindex.com.au/asx/dy6/announcements/annual-report-2024-6A1228609

https://www.listcorp.com/asx/dy6/dy6-metals-ltd/news/annual-report-2024-3092874.html

https://www.intelligentinvestor.com.au/shares/asx-dy6/dy6-metals-ltd/announcements?page=4

https://www.marketindex.com.au/asx/dy6/announcements/results-of-agm-6A1239270

https://simplywall.st/stocks/au/materials/asx-dy6/dy6-metals-shares/past

https://www.intelligentinvestor.com.au/shares/asx-dy6/dy6-metals-ltd

https://www.nasdaq.com/articles/rare-earths-stocks-5-biggest-asx-companies-2024

https://simplywall.st/stocks/au/materials/asx-dy6/dy6-metals-shares

https://www.listcorp.com/asx/dy6/dy6-metals-ltd/news/company-presentation-3189180.html

https://www.fool.com.au/investing-education/asx-rare-earths-shares/

https://mining.com.au/dy6-shares-spike-amid-commissioning-tundulu-testwork/

https://thebull.com.au/commodities/how-to-invest-in-asx-rare-earth-stocks/

https://www.ig.com/au/trading-strategies/5-of-the-best-rare-earth-stocks-on-the-asx-230419

https://www.mining-technology.com/news/dy6-tundulu-rare-earth-project/

https://ar3.com.au

https://ph.investing.com/pro/ASX:DY6/compare/ASX:RLC,ASX:CVR,ASX:TAR,ASX:SUM,ASX:UVA,ASX:AS2

https://simplywall.st/stocks/au/materials/asx-bre/brazilian-rare-earths-shares

https://www.listcorp.com/asx/bre/brazilian-rare-earths-limited

https://simplywall.st/stocks/au/materials/asx-lyc/lynas-rare-earths-shares

https://simplywall.st/stocks/au/materials/asx-aru/arafura-rare-earths-shares

https://au.investing.com/equities/dy6-metals-consensus-estimates

https://simplywall.st/stocks/au/materials/asx-dy6/dy6-metals-shares/future

https://discoveryalert.com.au/news/gallium-discovery-tundulu-high-grade-rates/

https://simplywall.st/stocks/au/materials/chia-dy6/dy6-metals-shares/future

https://dy6metals.com/wp-content/uploads/2024/06/202406_DY6_Flyer_v5.pdf

https://walletinvestor.com/asx-stock-forecast/dy6-stock-prediction

https://simplywall.st/stocks/au/materials/chia-dy6/dy6-metals-shares/valuation

https://www.barrons.com/market-data/stocks/dy6/research-ratings?countrycode=au