Executive Summary

Locksley Resources Limited operates as a speculative exploration company focused on critical minerals, with flagship assets in rare earth elements (REE) and antimony in both Australia and the United States. The company is positioned at the intersection of two rapidly expanding commodity sectors—rare earths and antimony—both experiencing significant price surges and supply chain disruptions due to geopolitical tensions and increasing demand for clean energy technologies.

Investment Recommendation: BUY

Confidence Level: Medium

Expected Timeframe: 12-18 months

1. Fundamental Analysis

Financial Performance

Revenue and Profitability Trends123

Revenue declined 50.4% from A$66,540 in FY2023 to A$32,986 in FY2024

Net loss increased 42.0% from A$1.50M in FY2023 to A$2.13M in FY2024

Gross margin remains at 100% (typical for exploration companies with minimal operational revenue)

Operating margins are deeply negative at -6,468% in FY2024, reflecting the pre-revenue exploration phase

Operating cash flow deteriorated from -A$1.41M in FY2023 to -A$2.03M in FY2024

Free cash flow declined from -A$1.41M to -A$2.06M, indicating increased capital requirements

Cash burn rate of approximately A$1.31M over the trailing twelve months ending December 2024

Cash position remains adequate at A$2.3M as of June 2024, providing runway for operations

Total assets increased 17.9% to A$8.63M, primarily driven by exploration asset additions

Total equity strengthened 28.5% to A$8.46M, reflecting successful capital raising activities

Debt-to-equity ratio of 0.02 indicates minimal financial leverage

Current ratio of 12.13 demonstrates strong short-term liquidity position

Valuation Metrics67

Current Trading Multiples

Market capitalization: A$22.0M (at A$0.12 per share)

Enterprise value: A$19.7M

Price-to-book ratio: 1.96x

Price-to-sales ratio: 360x (not meaningful for exploration companies)

EV/Sales: 176x (elevated due to minimal revenue)

Sector Comparison7

P/E ratio: Not applicable (loss-making)

P/B ratio: 1.96x vs sector average of 1.6x

Price/LTM Sales: 360x vs sector average of 1.2x

Beta coefficient: 1.84 (highly volatile relative to market)

Insider Trading Activity89

Recent Insider Transactions

Nathan Lude (Non-Executive Chairman): Purchased 1,563,646 shares at A$0.022 in June 2024 (A$34,400 investment)

Stephen Brockhurst (Former Director): Purchased 950,000 shares at A$0.041 in October 2023 (A$38,959 investment)

Multiple option grants to directors and management in 2023, indicating continued commitment

Current Insider Ownership9

Individual insiders hold 17.8% of outstanding shares

Institutional ownership: 13.0%

Private companies: 8.69%

General public: 60.5%

2. Thesis Validation

Bullish Arguments

1. Critical Minerals Exposure to Unprecedented Price Surge1011

Antimony prices have surged 1,000% from US$5,500/tonne in 2019 to US$57,000-60,000/tonne in 2025

China's export restrictions have created a supply crisis, with international buyers paying double domestic Chinese prices

Rare earth elements market projected to grow from US$12.4B in 2024 to US$37.1B by 2033 (CAGR of 12.83%)

2. Strategic US Asset Positioning1213

Mojave Project strategically located adjacent to the only producing rare earth mine in the US

Recent drilling permit approval for the Desert Antimony Mine provides clear development pathway

US advisor appointment (Viriathus Capital LLC) to facilitate government relationships and funding opportunities

Potential beneficiary of US critical minerals policy supporting domestic supply chains

3. Strong Balance Sheet with Operational Flexibility56

Minimal debt burden (debt-to-equity ratio of 0.02) provides financial flexibility

Strong cash position of A$2.3M provides operational runway

Recent successful capital raising of A$1.47M in May 2025 demonstrates investor confidence

Low-cost exploration opportunities with high-grade surface samples already identified

Counter-Arguments and Key Risks

1. Commodity Price Volatility Risk1415

Rare earth prices historically volatile with significant downturns in 2023 (praseodymium oxide fell 34%)

Antimony price surge may not be sustainable long-term without sustained supply disruptions

Geopolitical tensions with China could normalize, reducing price premiums

2. Execution and Development Risk1617

Permitting delays possible despite recent approvals, particularly for US operations

No established production or revenue stream beyond minimal exploration-related income

Significant capital requirements for development phase may necessitate substantial dilution

Technical risks in transitioning from exploration to production phases

Final Verdict: Bullish

The convergence of extreme commodity price appreciation, strategic asset positioning, and supportive policy environment creates a compelling investment opportunity. While execution risks remain significant, the potential upside from successful development of high-grade antimony and REE deposits substantially outweighs the downside risk, particularly given the company's strong balance sheet and minimal debt burden.

3. Sector & Macro View

Sector Overview1819

Australian Mining Sector Context

Mining contributes 15% of Australia's GDP and employs over 1.1 million people

Critical minerals focus driven by energy transition and supply chain security concerns

Government support through tax incentives and expedited permitting for strategic minerals

Copper and gold prices expected to drive exploration activity, though financing remains challenging

Macroeconomic Trends2021

Global Rare Earth Elements Market

Market size: US$12.4B in 2024, projected to reach US$37.1B by 2033

China dominance: 58.3% market share, creating supply chain vulnerabilities

Demand drivers: Electric vehicle production, renewable energy systems, defense applications

Critical supply gap: Dysprosium demand projected to rise 2,600% over next 25 years

Market size: US$4.76B in 2024, projected to reach US$6.54B by 2029

China controls 75% of global antimony production

Supply deficit emerged in 2021 for the first time in history

Growing applications in lithium-ion batteries, solar panels, and flame retardants

Competitive Positioning2312

Locksley's Strategic Advantages

Dual commodity exposure to both REE and antimony markets

Geographic diversification across Australia and US assets

Early-stage development with potential for significant value creation

Strong government relations through experienced leadership team

Competitive Landscape

Lynas Rare Earths (ASX:LYC): Market cap A$9.35B, established producer

Mandalay Resources (TSX:MND): Only antimony producer in Australia (1,282 tonnes in 2024)

Limited competition in combined REE/antimony space creates differentiation opportunity

4. Catalyst Watch

Short-Term Catalysts (3-6 months)

Operational Milestones

Drilling commencement at Mojave Project (expected Q3 2025)

Quarterly activity reports (next due July 29, 2025)

Initial drilling results from Desert Antimony Mine (expected Q4 2025)

Permitting updates for additional exploration areas

Market Catalysts

Antimony price movements driven by Chinese export policy changes

US critical minerals policy announcements and funding opportunities

Rare earth price recovery as market supply-demand balance stabilizes

Long-Term Catalysts (6-18 months)

Development Milestones

Maiden resource estimate for Mojave Project antimony deposits

Preliminary economic assessment for development scenarios

Additional land acquisition or strategic partnerships

Potential off-take agreements with US government or industrial users

Strategic Catalysts

US government investment or strategic partnership (similar to Pentagon's 15% stake in REE companies)

Major mining company joint venture or acquisition interest

Technology developments in REE processing or antimony applications

Geopolitical developments affecting China trade relationships

Risk Events

Permitting delays or regulatory changes

Commodity price corrections in either REE or antimony markets

Funding shortfalls requiring dilutive equity raises

Technical challenges in exploration or development phases

5. Investment Summary

Investment Thesis (5 Key Points)

Exceptional commodity exposure to antimony (1,000% price surge) and rare earth elements (12.83% CAGR market growth) during unprecedented supply chain disruption

Strategic US asset positioning with drilling-ready Desert Antimony Mine and high-grade REE prospects adjacent to America's only producing rare earth mine

Strong financial foundation with A$2.3M cash, minimal debt (0.02 debt-to-equity), and recent successful capital raising providing operational runway

Supportive policy environment with US critical minerals strategy, expedited permitting, and potential government partnership opportunities

Significant value creation potential from early-stage exploration to resource development in high-demand, strategically important commodities

Final Recommendation: BUY

Price Target: A$0.18-0.22 (50-83% upside potential)

Confidence Level: Medium

Expected Timeframe: 12-18 months

Investment Rationale: Locksley Resources offers exceptional exposure to two of the most rapidly appreciating commodity sectors (antimony and rare earth elements) through strategically positioned assets in stable jurisdictions. The company's strong balance sheet, experienced management team, and supportive policy environment create a compelling risk-adjusted opportunity for investors seeking exposure to critical minerals essential for energy transition and national security. While execution risks remain significant, the potential for substantial value creation through successful resource development substantially outweighs the downside risk at current valuation levels.

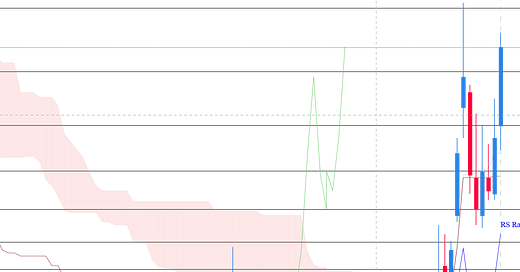

[image:1]

This report is based on publicly available information as of July 16, 2025. Past performance does not guarantee future results. Investors should conduct their own due diligence and consider their risk tolerance before making investment decisions.

https://stockanalysis.com/quote/asx/LKY/financials/cash-flow-statement/

https://simplywall.st/stocks/au/materials/asx-lky/locksley-resources-shares/ownership

https://discoveryalert.com.au/news/antimony-market-surge-2025-obscurity-critical-metal/

https://smallcaps.com.au/antimony-market-further-growth-critical-minerals-demand-skyrockets/

https://discoveryalert.com.au/news/rare-earth-market-2025-trends-outlook/

https://locksleyresources.com.au

https://www.linkedin.com/pulse/state-australian-mining-industry-2025-regan-woolley-as5yc

https://www.researchandmarkets.com/reports/5936167/rare-earth-elements-market-report

https://www.researchandmarkets.com/reports/6103830/rare-earth-elements-global-market-report

https://www.thebusinessresearchcompany.com/market-insights/antimony-market-overview-2025

https://mining.com.au/antimony-surge-catches-market-off-guard/

https://simplywall.st/stocks/au/materials/asx-lky/locksley-resources-shares

https://www.annualreports.com/HostedData/AnnualReportArchive/l/ASX_LKY_2023.pdf

https://simplywall.st/stocks/au/materials/asx-lyc/lynas-rare-earths-shares

https://in.investing.com/equities/locksley-resources-financial-summary

https://www.intelligentinvestor.com.au/shares/asx-lky/locksley-resources-limited/financials

https://www.reuters.com/markets/companies/LKY.AX/all-listings

https://www.listcorp.com/asx/lky/locksley-resources-limited/news/half-year-accounts-3164302.html

https://www.annualreports.com/HostedData/AnnualReportArchive/l/ASX_LKY_2022.pdf

https://investors.locksleyresources.com.au/announcements?filter=reports

https://au.investing.com/equities/locksley-resources-cash-flow

https://www.marketwatch.com/investing/stock/lkyrf/financials/cash-flow

https://www.deloitte.com/au/en/Industries/mining-metals/research/tracking-the-trends.html

https://hetherington.net.au/key-trends-shaping-australias-mining-and-resources-industry-2025/

https://blog.tbrc.info/2024/10/antimony-market-key-insights/

https://www.fortunebusinessinsights.com/rare-earth-elements-market-102943

https://miningdigital.com/top10/top-10-australian-mining-companies

https://minerals.org.au/resources/focus-on-partnerships-that-support-and-enrich-communities/

https://twelvedata.com/markets/966881/stock/asx/lky/statistics

https://www.marketscreener.com/quote/stock/LOCKSLEY-RESOURCES-LIMITE-191242405/

https://www.listcorp.com/asx/sectors/materials/materials/metals-mining

https://au.investing.com/equities/locksley-resources-consensus-estimates

https://www.insidermonkey.com

https://www.ig.com/au/trading-strategies/are-these-the-best-asx-mining-stocks--221223

https://www.marketscreener.com/quote/stock/LOCKSLEY-RESOURCES-LIMITE-190760541/company/

https://www.pwc.com.au/industry/mining/aussie-mine-2021/aussie-mine-2021.pdf

https://thebull.com.au/news/upcoming-earnings-and-dividends-19th-may-2025/

https://www.industryevents.com/events/the-11th-int-l-conference-on-catalysis-icc-2025

https://revenue.ky.gov/Business/Pages/Employer-Payroll-Withholding.aspx

https://www.eventbrite.com/e/2025-community-catalyst-conference-tickets-1251672138059

https://www.kiplinger.com/investing/stocks/17494/next-week-earnings-calendar-stocks

https://ng.investing.com/equities/locksley-resources-financial-summary

https://www.tradingview.com/symbols/ASX-LKY/financials-income-statement/